Are you familiar with these types of loans? These are the ones, I would strongly encourage you to stay away from:

1. Payday loans aka payday advances rely on your employment / payroll history. You borrow short term money to be paid back at your next pay date. These are unsecured in the sense that there is no collateral. Depending on how the interest is calculated by individual state regulations (in the states that allow them), your interest rate can be upwards in the hundred percentage range. Not a very cost effective way to borrow money.

2. Balloon loans / mortgages: These types of loans are NOT fully amortized. With most “good” loans you make an agreed upon payment, and at the end of the term the loan is paid in full. But that is not the case with a balloon loan. Your payments are not high enough to pay off the loan at the end of the term. Once you think you are finished, you end up with a very large final payment which may be 50%, 60% or even 100% of your principal (hence the name ‘balloon’).

3. Rent-to-own loans: You make rental / lease payments towards the ownership of an item (furniture, TV, computer, etc.). You can terminate the rental / lease at any point and return the item, though there may be a penalty. Once the agreed upon payments are made, the item is yours. This looks like an affordable way to get what you want right away, but it isn’t. Typically, you pay substantially more for the item than if you just used a credit card.

In each of these cases, borrower beware. Read and understand any legal agreements prior to signing. You need to understand what you are getting into and for how long, so that you can make an informed choice that is right for you and your situation. If you don’t understand the contract or feel pressured, that would be your signal to walk away.

Maclyne Josselin might catch the eye of any corporate comptroller looking to build a staff, keeping a ledger within arm’s reach in which she tracks income and expenses to the penny.

Maclyne Josselin might catch the eye of any corporate comptroller looking to build a staff, keeping a ledger within arm’s reach in which she tracks income and expenses to the penny.

Do you know what’s really scary? Having company due in 5 minutes when the bathrooms aren’t clean. When that happens, do you lock the front door and pretend you’re not home? No! You walk into the bathroom and decide which part needs to be cleaned first (just in case you run out of time before the doorbell rings).

Do you know what’s really scary? Having company due in 5 minutes when the bathrooms aren’t clean. When that happens, do you lock the front door and pretend you’re not home? No! You walk into the bathroom and decide which part needs to be cleaned first (just in case you run out of time before the doorbell rings).

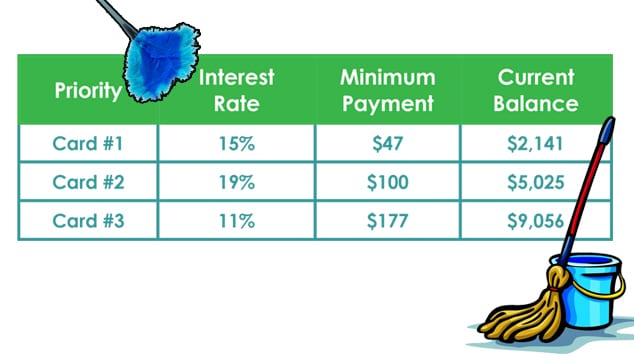

We’ve been on the

We’ve been on the  I was able to pay more than the minimum on my credit card bill

I was able to pay more than the minimum on my credit card bill