I am rerunning a post from 2016 that has been really relevant to us so far this year (and the last week of last year too). We had three events between the holidays and now, that we are so grateful for our emergency fund. It saved us again!

I am rerunning a post from 2016 that has been really relevant to us so far this year (and the last week of last year too). We had three events between the holidays and now, that we are so grateful for our emergency fund. It saved us again!

We woke up on a Sunday morning to no heat or hot water. If that wasn’t bad enough, our plumber was away for the weekend. The installer of the system was attending a football game was wasn’t available. Luckily, we found a temporary solution. That was great because the part took two weeks to come in (as it was back ordered). Next, I was driving home on the highway and I had car trouble. Help came quick and it was a minor repair. Lastly, the furnace began dripping and another call for service. All in all, this could have been a really expenses month on top of our regular bills. We were fortunate enough to have an emergency fund to rely on when needed.

In praise of emergency funds! I can’t say enough about having an emergency fund to use in times of an emergency, as well as having the protection of insurance. We had a big life emergency this time, and it could have been much worse.

While Dave and I were out of the house for about an hour and a half, an emergency struck our house. A feeder line for the toilet broke and we came back to a small geyser. Not only was the bathroom flooded, the water flowed into the master bedroom and then down into the basement. Ugh! You can imagine the damage this has caused. But it could have been much worse.

So this is how our afternoon went:

* Shut off the water – we had individual shutoffs installed all over the house

* Next the clean-up began – towels, wet vacuums and more

* Contacted the insurance company to file a claim. This is the first homeowners claim we ever filed.

* Started the removal of the damaged stuff, and this was hard without Dave being able to move things.

* The insurance company sent out Service Master to remediate the damage. They moved the heavy furniture, installed the industrial fans and dehumidifiers to lessen the damage

* Next day we had to replace the modem, as we lost phone and internet service. It’s difficult to make multiple calls with only a cell phone.

* The drying out stage lasted for days. It included the carpets, hardwood floors, ceramic tiles, sheet rock, furniture and that’s only the big stuff!

Now we are at the rebuilding stage, with the contractors giving us estimates for replacing floors, hard wood and tile, sheet rocking the portion of the walls that were cut away with water damage, painting of rooms, replacing furniture and items that were damaged and more.

Living in a disorganized home as two rooms of furniture and personal items had to be moved out of the rooms and the basement, made our home somewhat of an obstacle course for quite a few weeks. Hopefully by the holidays, we can be back to our organized house.

What’s your emergency savings account look like? Suze Orman suggests that you have eight months of income in your emergency savings. Dave Ramsey and Jean Chatzky both say 3 to 6 months. Hello Wallet suggest that you think of emergency saving in three ways – minor emergencies, major emergencies and job loss. Bottom line, you need an emergency savings account.

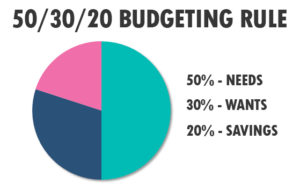

What’s your emergency savings account look like? Suze Orman suggests that you have eight months of income in your emergency savings. Dave Ramsey and Jean Chatzky both say 3 to 6 months. Hello Wallet suggest that you think of emergency saving in three ways – minor emergencies, major emergencies and job loss. Bottom line, you need an emergency savings account. This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category  Do you have an emergency fund? You never know what could happen in life. Experts say you should have 6 months to a year worth of income on hand for life’s what ifs. Yes, that can be overwhelming to go from minimal savings to this goal. Start by finding ways to save $5 a day to start. Automate your savings goals so that they happen. #JillRussoFoster #FinancialLiteracyMonth

Do you have an emergency fund? You never know what could happen in life. Experts say you should have 6 months to a year worth of income on hand for life’s what ifs. Yes, that can be overwhelming to go from minimal savings to this goal. Start by finding ways to save $5 a day to start. Automate your savings goals so that they happen. #JillRussoFoster #FinancialLiteracyMonth