We all hear about the college students and the money mistakes they made while in college. I was one of them. This article from US News shares the top six mistakes and gives you ideas to think about. Read more

Tips for Successful Personal Finances

We all hear about the college students and the money mistakes they made while in college. I was one of them. This article from US News shares the top six mistakes and gives you ideas to think about. Read more

It ‘s that time of year. Your teens are making their college choices for the fall and all the excitement that goes with it. What school should they go to? Will they stay near or go far? What will I need to do next?

It ‘s that time of year. Your teens are making their college choices for the fall and all the excitement that goes with it. What school should they go to? Will they stay near or go far? What will I need to do next?

First let ‘s start with the paying for college. If you have the money saved for the cost of college for all four years (or more), then you can stop reading. If not, you need to start or continue to figure out the finances. FAFSA – Free Application for Federal Student Aid – is the first step. Apply now, even if you don’t think you qualify – you may be surprised.

Here is a great article by Consumer Reports for financial aid that will tell you what you need to know.

This is a great memory from my childhood. I loved going with my mom to the library and taking out a book. In fact, I still use the local library and read many books each year.

In honor of Take Your Child To The Library Day which is February 3, 2018, I am offering you a 20% discount on my book Cash, Credit and Your Finances: The Teen Years from now until February 3. For $20.00 you can purchase a copy of my book directly from me, have it personalized to your recipient and it including priority shipping. This is only available from my website. Click here to purchase.

Voted “Best Teen Book” by Radical Parenting Teen Team

Cash, Credit, and Your Finances: The Teen Years looks at finances through the eyes of five different teenagers. They all have things they want and need, but they all handle their money differently. Some will succeed and some will give up… which one do you want your child to be?

Start your child off with the gift of reading and learning great money skills. Buy Cash, Credit and Your Finances: The Teen Years now!

![]()

Today, I am doing a workshop, Money Make The World go Round at Empower Her for kids ages 8 to 11. We are going to discuss budgeting, wants, needs with the help of a fun game!

Spring is a great time of year! One of my favorites, as the weather turns warmer and the days are longer. For us, it means more time outside and that can be from getting my garden planted and the thrill of fresh vegetables right in my backyard, to having meals outside; either just us or with friends and family. We can open the windows to air out the winter stale indoor air and sleep comfortably with the windows open all night. It means exploring the outdoors, maybe taking a walk in a new neighborhood or park, picnics and movies in the park.

With spring comes weddings and graduations – new beginnings. This can be true for all of us, even if we don’t have a milestone event coming up.

Traditionally, spring makes me think of spring cleaning and tackling the heavier cleaning throughout the house. We can do the same for our finances. For the graduate, you can start them off with the gift of good finances – being able to start to plan their money and finance proactively and make planned purchases versus impulse buying. A great way to start would be the gift of my book, Cash Credit and Your Finances: The Teen Years.

For those who want to get your own finances back on track, 111 Ways to Save or Thrive In Five: Take Charge of Your Finances in 5 Minutes a Day will give you the push you need to get your finances in order.

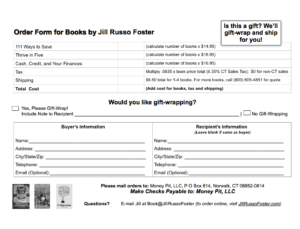

You can order my books through my website or by order form. If you use the order form, you have the option of me personalizing the book. Just print the order form, fill out the recipient information section, and mail it to the address on the form or fax it to 203-504-7995. For the month of June 2017, we are also offering free shipping on all book sales that are ordered with the order form via mail or fax.

Click here to download the order form.

Save

This is a great article about recent grads and tips for getting their first time job. Read more

Do you want your teen to start off their money and finances is a good way? Teach them to make choices that are right for them and come from a place of understanding. Give them the gift of Cash, Credit and Your Finances: The Teen Years. It’s simple to order at JillRussoFoster.com. If you want them book personalized to them, use this order form to order from us directly.

What do you think?

So, you’ve prepared your child for college, which includes buying him a decent laptop. That’s where he’ll store all his homework, access his assignments and turn in his papers. Should be good to go, right?

Wrong. Imagine this: Your child just finished writing this really great paper and it’s due in two hours. Suddenly, the computer crashes. Maybe it’s a virus. Maybe it was because of the soda he spilled on it last night. The ‘why’ doesn’t matter right now – all that matters is that a full semester’s work was lost in a few seconds.

What’s your kid going to do?

Hopefully, he’ll…

1. Borrow another computer from a friend or the school to…

2. Access his files from the external hard drive in his room or from his cloud backup service, and…

3. Send his paper on time.

If you don’t understand anything in Step 2, read on:

External Hard Drive

This is an external storage device separate from your computer. It’s portable – from the size of a wallet to a small box. You plug it into the computer with a USB cable.

Pros: You don’t need the internet to access your files. It’s portable and you can plug it into any other computer as needed. You pay one-time for the device and not a service.

Cons: It can be lost, stolen or damaged and you need to remember to back up your files.

Cloud Backup Service

In simple terms, this is a service that stores a copy of your files on the internet. It backs up continuously and automatically as long as there’s an active internet connection.

Pros: Backs up for you and you can access your files anywhere on any computer.

Cons: Need to keep paying for the service to access your files. Must have a functional internet connection to access files.

Now that you know the different types, why not both?

Backing up frequently is critical, but so is access. You can get a 1 terabyte external hard drive for around $60 and you can use a cloud backup service for $5 per month.

That’s cheap security considering you’ll be covered for both hardware and internet related disasters.

This all sounds scary, but what are the chances?

Using a computer for school or work opens you up to some major security risks that I think need to be addressed.

1. The actual item can be lost or stolen. (You should have a locate app installed to increase your chances of finding what’s been lost.)

2. Your computer can be infected by a virus or hacked.

3. It can be damaged by liquids, a power outage, or a simple accident.

4. User error. This is where you accidentally delete or overwrite your file.

With so many security issues, the chances of something happening are pretty big. Dorm rooms are crowded work/living spaces occupied by distracted teens. Things happen… a lot.

And, it’s happened to me – a grown up with my own spacious home. Back in June, I crashed my computer. I was saved by backups and the pros to get me up and running again – but it took at least a week. I can’t thank them enough. Now, not only do I have an external hard drive and cloud back up, I have added an automatic backup systems to be double safe.

If you’re getting ready to send your child off to college for the first time, here is a list of things you need to do, or have them do, before school starts.

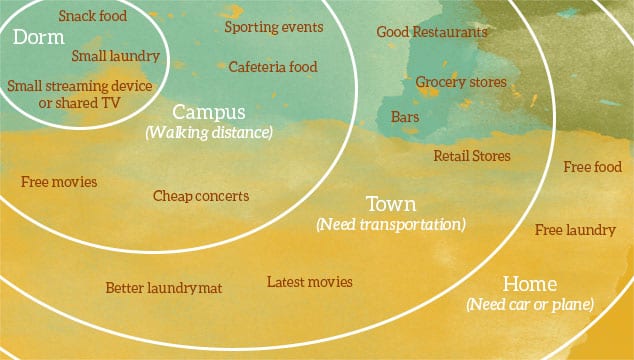

Research what it’s like to live on campus. What are the rules and regulations? Where is the best place to do laundry or buy food? What student groups are available? What’s the game schedule? When and where are the plays, the concerts and movies? What stores, restaurants and services are in walking distance? Visit the school’s website and Google Maps to start. From there you may find forums or groups that will help you plan for the place you’ll be living for the next year.

Buy or rent your text books online if possible. Text books are expensive. As soon as your class syllabus is available, start comparison shopping. What options are available to you? Downloadable? Hardcover-used but with shipping fees? The school book store may be the most expensive source, but if you wait until the last minute it will be your only choice. (Always use the ISBN to verify that you have the correct edition.)

Get to know your roommate. You’ll be sharing a very small space with someone you’ve never met. Summertime is the best time to reach out. Find out about them (likes and dislikes), set up of dorm room (who is bringing what) and discuss any issues you are concerned about ahead of time. If you need a roommate off campus (one that’s not assigned by the school), try roomsurf.com.

Doctors and dentists close to campus. It’s time to think about your child’s medical. Set up a physical before they head off to school. Renew prescriptions now so they can take it with them. Check with your insurance carrier to find doctors close to campus in network because emergencies happen. Out of network costs can be a drain on your budget.

Put Orientation on your calendar and go. This is your chance to get to know the school, campus, services and class information. This is a must for anyone going to college or going to a different school.

Technology. In the summer, you can get great deals on laptops, tablets, software, printers, etc. Find out what you need, and get it while the sales are hot.

Don’t wait until fall. Your child will be busy enough trying to handle living on their own for the first time. While the college dorm may seem like a cozy, self-contained environment, it can be surprisingly challenging for the unprepared.