For us, we look over our finances every January. Yes, we do this all the time, but this is the time we reassess everything. Here is what we do:

- Auto / Home and Umbrella insurance – we checked to see that we are paying a competitive annual rate for all policies

- We took our safe driving class to lower our auto insurance (This is something we do every three years)

- TV / Internet – we did this in December. Our current provider increased our internet, so we switched to the competition and cut our bill in half

- We set up automatic monthly payment from our checking account to lower our medical insurance premiums. Just switching from a credit / debit card to checking account, saved us money.

- We are in the process of consolidating accounts. We transferred retirement accounts from past employers to one account.

- We have started the process to update our wills, power of attorney, healthcare proxy and more. There is so much more with these with your digital footprint to consider.

These are some of the things we have done in previous years:

- We eliminated our trash and recycling services, saving us $75/ month. It costs us $25 annually for the Town permit. Savings = $825.

- We do our own yard work – lawn mowing and snow removal.

What are you doing in January with your finances?

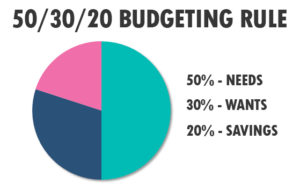

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category  Like Capital One says, What’s in your wallet? Could you tell me everything that is in your wallet right now? If you were to lose your wallet today, how would you know what to cancel and replace. Clean out your wallet and carry only the minimum you require. You should never carry your social security card, your PIN numbers / passwords, blank check(s), passport unless you need to use them that day. Identity theft is on the rise. Protect yourself. #JillRussoFoster #FinancialLiteracyMonth

Like Capital One says, What’s in your wallet? Could you tell me everything that is in your wallet right now? If you were to lose your wallet today, how would you know what to cancel and replace. Clean out your wallet and carry only the minimum you require. You should never carry your social security card, your PIN numbers / passwords, blank check(s), passport unless you need to use them that day. Identity theft is on the rise. Protect yourself. #JillRussoFoster #FinancialLiteracyMonth Do you feel like you are spending too much? Have you considered an all-cash month? Or how about a no spending month? Here are two great books to read to give you some ideas Not Buying It: My Year Without Shopping by Judith Levine or The Complete Tightwad Gazette by Amy Dacyczyn. #JillRussoFoster #FinancialLiteracyMonth

Do you feel like you are spending too much? Have you considered an all-cash month? Or how about a no spending month? Here are two great books to read to give you some ideas Not Buying It: My Year Without Shopping by Judith Levine or The Complete Tightwad Gazette by Amy Dacyczyn. #JillRussoFoster #FinancialLiteracyMonth Have you cut the cord or do you want to with your TV provider or streaming service? When was the last time you used your local library? With your library card you can download the Hoopla app and stream movies at home for free. #JillRussoFoster #FinancialLiteracyMonth

Have you cut the cord or do you want to with your TV provider or streaming service? When was the last time you used your local library? With your library card you can download the Hoopla app and stream movies at home for free. #JillRussoFoster #FinancialLiteracyMonth Now that you are not paying fees on your bank account, are you earning interest on your money? There are some amazing accounts (both checking and savings) with great interest rates. Shop around for the best rate without fees. #JillRussoFoster #FinancialLiteracyMonth

Now that you are not paying fees on your bank account, are you earning interest on your money? There are some amazing accounts (both checking and savings) with great interest rates. Shop around for the best rate without fees. #JillRussoFoster #FinancialLiteracyMonth Are you paying fees to your bank? You should be able to bank without fees. Some banks waive the fees with a minimum balance or direct deposit. Paying a monthly fee to have a bank account is a waste of your hard-earned money. #JillRussoFoster #FinancialLiteracyMonth

Are you paying fees to your bank? You should be able to bank without fees. Some banks waive the fees with a minimum balance or direct deposit. Paying a monthly fee to have a bank account is a waste of your hard-earned money. #JillRussoFoster #FinancialLiteracyMonth While thinking about saving money, what can you eliminate from your life that would save you money? Can you bring your choice of beverage from home versus buying? Can you stop buying bottled beverages? Do you bring your lunch with you from home? We have eliminated the trash removal / recycle bill by taking it ourselves. We went from $75/month to $25/year. How can you save? #JillRussoFoster #FinancialLiteracyMonth

While thinking about saving money, what can you eliminate from your life that would save you money? Can you bring your choice of beverage from home versus buying? Can you stop buying bottled beverages? Do you bring your lunch with you from home? We have eliminated the trash removal / recycle bill by taking it ourselves. We went from $75/month to $25/year. How can you save? #JillRussoFoster #FinancialLiteracyMonth