I always read these articles to make more changes to our finances

https://www.redbookmag.com/life/money-career/g4285/best-money-advice/

Tips for Successful Personal Finances

I always read these articles to make more changes to our finances

https://www.redbookmag.com/life/money-career/g4285/best-money-advice/

What do you think?

To start, we have been making better food choices over the past few years. As we get older, I want to still be active and healthy. This is a journey with small changes happening. We are striving for 50% of our plate to be vegetables. Our proteins are certified grass fed meats and fish with no antibiotics and non-GMO all while staying within our food budget. We shop what’s on sale and plan our meals to get the most from our dollars.

To start, we have been making better food choices over the past few years. As we get older, I want to still be active and healthy. This is a journey with small changes happening. We are striving for 50% of our plate to be vegetables. Our proteins are certified grass fed meats and fish with no antibiotics and non-GMO all while staying within our food budget. We shop what’s on sale and plan our meals to get the most from our dollars.

It’s that time of year to plan our garden and have fresh picked vegetables right in our backyard, at a minimal cost for organic seeds. Love this part of summer!

Here are some of our favorites to get more organic vegetables into our meals:

• Chicken Vegetable Soup making healthy bone broth with assorted vegetables. This is great to have on hand when we are short on time for dinner – just heat and eat.

• Lettuce wraps for lots of foods. Big leaf lettuce replaces the bread, wrap, taco and more. Inside can be anything from tuna to tacos – let your imagination run wild.

• Fries are one of my stress foods. But as I make these changes, there goes the fried foods. Now we bake or grill vegetable fries. Try it – avocado fries are one of favorites, but you can use many other veggies.

We are changing our food for the better. This wasn’t done overnight, just small changes (or baby steps) to gradually improve our choices. Our first step was to eliminate trans fats/partially hydrogenated oils, then came nitrates and then GMO’s. This exercise was eye-opening when I went through our pantry and even more surprising reading labels at the store.

As you can see, we are eating more at home and taking meals/snacks from home. Both are good things for our health and benefit our wallet too. More on the other areas of our lives that we have changed in the next issue.

Save

Save

Don’t be in credit card debt. Make a plan to pay it off.

https://wallethub.com/edu/credit-card-debt-study/24400/

Finances need a clean up, why not do this now for spring

It’s spring and with that we think about projects for our home each. What needs to be done for maintenance? What to we want / need to upgrade / replace? How much can we do ourselves vs. hiring out? How about doing home projects or repairs yourself.

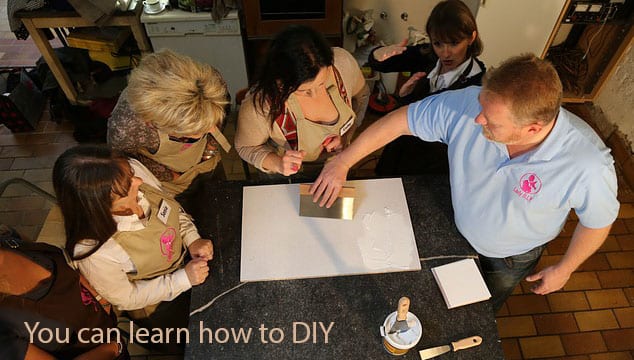

Do you have a broken tile that needs replacing? Do you want to refinish a piece of furniture? Do you want to repair a small leak? Do you want to create a patio? Before you jump into a DIY project, take a few hours to learn a little more about your project.

It’s easier than ever today to learn how to DIY. Home improvement stores offer free classes and/or you can watch a how-to video on the internet. It’s possible to learn from the pros, or from experienced tinkerers, just by setting aside a Saturday morning.

We renovated our current home and were able to do some of it ourselves. We did the demolition: ripped up carpets and vinyl flooring; removed kitchen and bath cabinets; and broke down the plaster walls. We also did as much of the work ourselves as we thought we could handle: we rolled out and stapled the insulation; and taped and painted the inside of the house.

That may be more than you want to tackle, but our partial DIY brought our home improvement project within our budget, so we could afford professional contractors to remove a load bearing wall, install a header beam, rewire the electricity, and add a bath.

Are you ready to tackle a home project or repair? The questions you should be asking yourself are:

Let me know what you decided, and good luck on your project! Tell me how it turned out in the comments.

The age-old question of payoff debt versus an emergency fund – which is more important?

If you have debt, then you know that the interest you are paying is a drain on your finances. You are correct, that interest is a waste of your hard-earned money. You know that you need an emergency fund and you have been meaning to start one, but you just don’t have the money.

Which should you tackle first? Let’s assume you have $500 in your budget to work with and we will look at a couple of scenarios.

#1 – You have debt totaling $10,000 and you are paying the minimum payment of $250 per month at an interest rate of 20%. It will take you 67 months (5+ years) and you will have paid back $16,750 ($6,750 in interest). That’s assuming you don’t take on more debt.

Then you put the remaining $250 to start your emergency fund.

#2 – You increase your payment on your debt to $500 per month. It will take you 25 months (just over 2 years) and you will have paid back $12,500.

You will not be starting your emergency fund until after the debt is paid. What would you do if an emergency expense happened? How would you pay for it?

As you can see, the answer is somewhere in the middle and you can think outside the box for faster results. You could look into reducing the interest rate on your debt – refinancing, balance transfer for a lower interest rate etc. The quicker you payoff the balance, the less you will pay in interest.

You need an emergency fund to be prepared for whatever happens in life. You will want to start to save something on a regular basis each and every month, even if you have debt.

Save

Have you ever written down a budget to see where your money is going? Well, we did this earlier this month and everything looks fine, meaning that we make more than we spend.

That means we can pay our bills – great! That’s check one. Check two – are we saving enough? No, we we’re not, but where do we get the money? We won’t find extra money to save until we find out exactly where our money is going.

If you want to do this process with me, follow these steps:

1. Write down a couple of short and long term goals, so you’ll be inspired to do the work.

Short term goals can be planning for a vacation, buying a car, paying down debt, saving for something that you want, and starting an emergency fund.

Long term goals can be saving to purchase a home, saving for your children’s education, retirement planning, and paying off debt/mortgage. What are yours? Imagine what you want or need and write it down now.

2. Track every penny you spend. That means finding a way to record your spending as it happens.

Don’t wait until the end of the month and use your bank statement or receipts. A single store can fall under many spending categories and receipts don’t always list items by name (or by names that you can decipher). Don’t think for a minute that your grocery store trip can be lumped under food. You may buy your pet food there, as well as cleaning supplies, shampoo, or even magazines.

I know this sounds time consuming, but it’s worth it. You can carry a pen and pad with you and write down everything by hand. Another way to track your money is by using a phone app. Choose the way that works best for your lifestyle.

3. Write your totals in a budget worksheet to see where you stand.

Once you see a month’s worth of numbers, than you can begin to analyze what is going on. With this clear picture, you can make changes – lower bills to save money, get rid of unused services, check out the competition to switch etc.

Tell me what you have discovered with this exercise. Next issue, I will tell you what we have changed.

Save

Save

Save