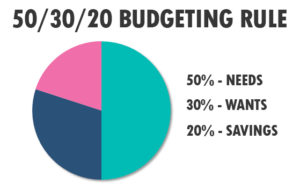

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category 50/30/20 Budget Calculator – NerdWallet. #JillRussoFoster #FinancialLiteracyMonth

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category 50/30/20 Budget Calculator – NerdWallet. #JillRussoFoster #FinancialLiteracyMonth

Financial Literacy Month #23

Do you have a surplus or deficit with your budget? We all know we can reduce or eliminate expenses. But sometimes this is not enough. Sometimes the answer will be that you need to increase your income or a combination of both. It’s something o think about. #JillRussoFoster #FinancialLiteracyMonth

Do you have a surplus or deficit with your budget? We all know we can reduce or eliminate expenses. But sometimes this is not enough. Sometimes the answer will be that you need to increase your income or a combination of both. It’s something o think about. #JillRussoFoster #FinancialLiteracyMonth

Financial Literacy Month #22

If you want to track your spending, there are many ways to do this: pen and paper, receipts for all spending, use your debit / credit cards or an app to see where your money is going. If you would like a copy of my budget tracker formulated in Excel let me know and I will give you a copy. #JillRussoFoster #FinancialLiteracyMonth

If you want to track your spending, there are many ways to do this: pen and paper, receipts for all spending, use your debit / credit cards or an app to see where your money is going. If you would like a copy of my budget tracker formulated in Excel let me know and I will give you a copy. #JillRussoFoster #FinancialLiteracyMonth

Financial Literacy Month #21

I would be remiss if I didn’t mention budgeting. When was the last time you tracked your spending? If you can’t remember when, it may be time to do this again. Learning where your money goes will help you to make changes so that you meet your goals. For example, “should I buy _______ or should I not spend this now and put it towards my goal of ____________.” #JillRussoFoster #FinancialLiteracyMonth

I would be remiss if I didn’t mention budgeting. When was the last time you tracked your spending? If you can’t remember when, it may be time to do this again. Learning where your money goes will help you to make changes so that you meet your goals. For example, “should I buy _______ or should I not spend this now and put it towards my goal of ____________.” #JillRussoFoster #FinancialLiteracyMonth

Financial Literacy Month #6

Do you have an emergency fund? You never know what could happen in life. Experts say you should have 6 months to a year worth of income on hand for life’s what ifs. Yes, that can be overwhelming to go from minimal savings to this goal. Start by finding ways to save $5 a day to start. Automate your savings goals so that they happen. #JillRussoFoster #FinancialLiteracyMonth

Do you have an emergency fund? You never know what could happen in life. Experts say you should have 6 months to a year worth of income on hand for life’s what ifs. Yes, that can be overwhelming to go from minimal savings to this goal. Start by finding ways to save $5 a day to start. Automate your savings goals so that they happen. #JillRussoFoster #FinancialLiteracyMonth

Are you curious about when to start social security?

That’s a question on a lot of people’s minds. Should I take it early at 62 or at my full retirement age or wait until I am 70.

Well wouldn’t it be great if you had a crystal ball to get the right answer for you. Well, we don’t and you want to make the right decision for your situation.

Here is an article from the Motley Fool that could give you some information that may help you make a decision that’s right for you.

America Saves Week – Living Below Your Means

This is an important lesson that we all have to learn with our finances. If we spend less than we earn, we have money to save and can pay our bills in full each and every month. If we spend more than we earn, we will incur debt. Debt creates a future obligation which is another expense for our budget.

Not all debt is bad debt, but debt can be the enemy of your budget. Good debt is paying for education that is going to give you a better job / career path. Bad debt is I want this now and I don’t have a way of paying for it, so I will use my credit card.

How do you know if you are living below your means? You need to track your spending for at least a month. Track your net income and all your expenses to see if you have more money coming in or more going out. This is the only way to see where your money is going. You might be surprised where your money is going. Once you see where your money is going, then it’s time to determine if you want or need to make changes to your expenses. It’s not always about reducing or eliminating your expenses. Sometimes the choice is that you need more income. You will never know until your see where your money is going.

Which Budgeting App Is Right For You?

Ever wonder what budgeting app is best for you and your family? Not sure where to start? I am asked this all the time and I don’t have a recommendation for you. I still use a manual method and am happy with that for us.

Ever wonder what budgeting app is best for you and your family? Not sure where to start? I am asked this all the time and I don’t have a recommendation for you. I still use a manual method and am happy with that for us.

For those of you that do want to use an app, how do you make the right choice? Here is a great article from The Hartford comparing several apps to help you make the right choice.

Let me know what one you use and why. I would love to hear from you.

Married Finances: Should Two Become One?

Weddings are an emotional celebration. We love the idea of a bride and groom starting a new life together. We use words like “two becoming one” or “sharing your lives as one,” meaning that everything will be shared as though the couple are no longer individuals. I believe this puts a lot of unnecessary sentimental pressure on a couple to share all their finances even though it’s not always necessary, or even wise, to do so for every single account or property.

Weddings are an emotional celebration. We love the idea of a bride and groom starting a new life together. We use words like “two becoming one” or “sharing your lives as one,” meaning that everything will be shared as though the couple are no longer individuals. I believe this puts a lot of unnecessary sentimental pressure on a couple to share all their finances even though it’s not always necessary, or even wise, to do so for every single account or property.

So, how do you merge two separate financial lives? There are many successful ways to do this. Some couples keep their individual incomes and expenses separate by having separate bank accounts, credit cards etc. Then, they have a joint expense account for their household bills that they each put money into. Sharing the joint account can be as simple as having each person responsible for different bills, or figuring out the bill totals and having each put in their half. Some people base the joint account total on a salary percentage (this works great when one spouse earns more money that the other). And, of course, some people merge everything and all accounts are joint.

You need to think about what type of financial people you are. Here are 3 questions to think about that will help you decide (and could possibly save some financial squabbles):

- Are you a saver and your spouse a spender? Having one person be the fall back for financial emergencies can be challenging financially and to the marriage.

- Are you both spenders? What will happen when there are no reserves for emergencies?

- How do you each handle bill payment? Are all your bills paid on time? Do you have bills that have slipped through the cracks?

Answers to these questions can be tricky, but worth the discomfort. Proactive thought can be a financial life saver for your future. Double check your answers by looking at your account statements and credit reports. You may not be as good at finances as you think you are, or you might be better than you thought. Discuss your habits with each other, as well as any outstanding issues that could affect you both.

I am a firm believer that you both should participle in your finances. You have joint goals in your future, so you should do the financial planning for this together as well. Don’t let the responsibility fall to one person. If something were to happen to the “responsible” one, then the other party would be left completely in the dark, not knowing anything about the accounts or how to deal with them. I have seen many situations like this. It may seem kind, or convenient, to handle the money if your partner doesn’t know how, but it’s not.

Whichever way you choose to handle your finances as a married couple, make sure it’s a mutual decision based on real knowledge of your habits and goals.

You Need An Emergency Savings

Whether you have been laid off, furloughed or salary reduced, you need an emergency savings to fall back on more than ever.

What’s your emergency savings account look like? Suze Orman suggests that you have eight months of income in your emergency savings. Dave Ramsey and Jean Chatzky both say 3 to 6 months. Hello Wallet suggest that you think of emergency saving in three ways – minor emergencies, major emergencies and job loss. Bottom line, you need an emergency savings account.

As with any goal, start with a plan – then automate it. When we started our emergency savings, our goal was to save $1,000. That would get us through the unexpected small expense. We started by saving $20 per week to reach that $1,000 goal in one year. Maybe that’s not possible in these challenging times, can you find $5 per week. While you are home, it’s a good time to review your bills, to find savings. Take a look at your credit card / bank statements, are there automatic changes you are paying for and not using? Can you replace an expense with something free? Can you reduce an expense to save money?

Once you accomplish your goal, I would like you to about your next savings goal. Sometimes unexpected emergencies cost more than you expect, especially if you are a homeowner. I have always thought that the major repair emergency fund should be in the $5,000 range. So then we started on this goal. $100 a week gets you to $5,000 in a year. We divided this between both our paychecks. My husband gets paid weekly so he contributes $50 each week. I get paid every other week, so I put in $100. We then have achieved this goal of $5,000 in a year.

Remember, this is not a save for one year and done type of thing. You may need to use this money, so you need to replace what you use. You can never have too much money saved for the what if’s of life.

- 1

- 2

- 3

- …

- 7

- Next Page »