I have been writing for years to bring you important personal finances information that I think you should know about. I want to turn the tables and ask you what you want to know about. Here are some suggestions and another section to add more.

| Personal Finances |

| Budgeting |

| Reducing Expenses |

| Saving for Your Future |

| Teens and Money |

| Credit |

| Understanding How It Works |

| Improving Your Score |

| Debt |

| Loans and Mortgages |

| Other |

| ___________________________ |

Tell me what you want to know about in the comments.

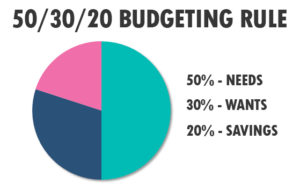

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category