Register Your Teen for Teens and Money – register today!

Come and join me for Kids On Campus at Norwalk Community College (Norwalk, CT) this summer. I will be offering a workshop, Teens and Money: Teens Personal Finance for grades 9 to 12 for 1 week only – July 21 to 25, 2025 from 9 to 12. To register contact 203-857-7080.

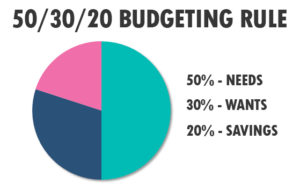

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category  Now that we are past the frost, it’s time to start our garden. I save our cardboard egg containers to use to start my seeds. Buying seeds (our library gives out free seeds) and starting them indoors will create a budget friendly alternative to buying vegetables at the grocery store. Don’t worry if you don’t have a yard, container gardening works just as well. Simply start with growing your own lettuce or herbs. It’s easy and will help your budget. #JillRussoFoster #FinancialLiteracyMonth

Now that we are past the frost, it’s time to start our garden. I save our cardboard egg containers to use to start my seeds. Buying seeds (our library gives out free seeds) and starting them indoors will create a budget friendly alternative to buying vegetables at the grocery store. Don’t worry if you don’t have a yard, container gardening works just as well. Simply start with growing your own lettuce or herbs. It’s easy and will help your budget. #JillRussoFoster #FinancialLiteracyMonth There are other types of insurance you need. If you own or lease a car, you need auto insurance. If you own a home / condo, you need homeowner insurance. If you rent an apartment, you need renter’s insurance. With what is going on in the country (floods, wildfires, mudslides etc.) Make a plan to have your needs assessed so that you’re covered for anything that may happen. #JillRussoFoster #FinancialLiteracyMonth

There are other types of insurance you need. If you own or lease a car, you need auto insurance. If you own a home / condo, you need homeowner insurance. If you rent an apartment, you need renter’s insurance. With what is going on in the country (floods, wildfires, mudslides etc.) Make a plan to have your needs assessed so that you’re covered for anything that may happen. #JillRussoFoster #FinancialLiteracyMonth

Let’s talk about insurance. Do you have all the insurance coverage you need? Do you have health insurance to cover medical care when needed? Most employers offer this to their employees. If you don’t have it through your job, there are other ways to access health insurance. Every state offers some type of insurance. One major medical incident can ruin a budget without insurance. #JillRussoFoster #FinancialLiteracyMonth

Let’s talk about insurance. Do you have all the insurance coverage you need? Do you have health insurance to cover medical care when needed? Most employers offer this to their employees. If you don’t have it through your job, there are other ways to access health insurance. Every state offers some type of insurance. One major medical incident can ruin a budget without insurance. #JillRussoFoster #FinancialLiteracyMonth