It’s spring and with that we think about projects for our home each. What needs to be done for maintenance? What to we want / need to upgrade / replace? How much can we do ourselves vs. hiring out? How about doing home projects or repairs yourself.

Do you have a broken tile that needs replacing? Do you want to refinish a piece of furniture? Do you want to repair a small leak? Do you want to create a patio? Before you jump into a DIY project, take a few hours to learn a little more about your project.

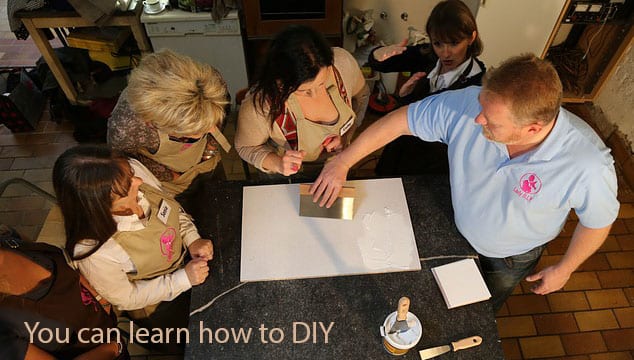

It’s easier than ever today to learn how to DIY. Home improvement stores offer free classes and/or you can watch a how-to video on the internet. It’s possible to learn from the pros, or from experienced tinkerers, just by setting aside a Saturday morning.

We renovated our current home and were able to do some of it ourselves. We did the demolition: ripped up carpets and vinyl flooring; removed kitchen and bath cabinets; and broke down the plaster walls. We also did as much of the work ourselves as we thought we could handle: we rolled out and stapled the insulation; and taped and painted the inside of the house.

That may be more than you want to tackle, but our partial DIY brought our home improvement project within our budget, so we could afford professional contractors to remove a load bearing wall, install a header beam, rewire the electricity, and add a bath.

Are you ready to tackle a home project or repair? The questions you should be asking yourself are:

- Do you have the time and energy needed to complete the project?

- Do you know how, or could you learn the skills needed, to complete the project?

- Can you afford to have the work completely hired out?

Let me know what you decided, and good luck on your project! Tell me how it turned out in the comments.

I was busy yesterday.

I was busy yesterday.