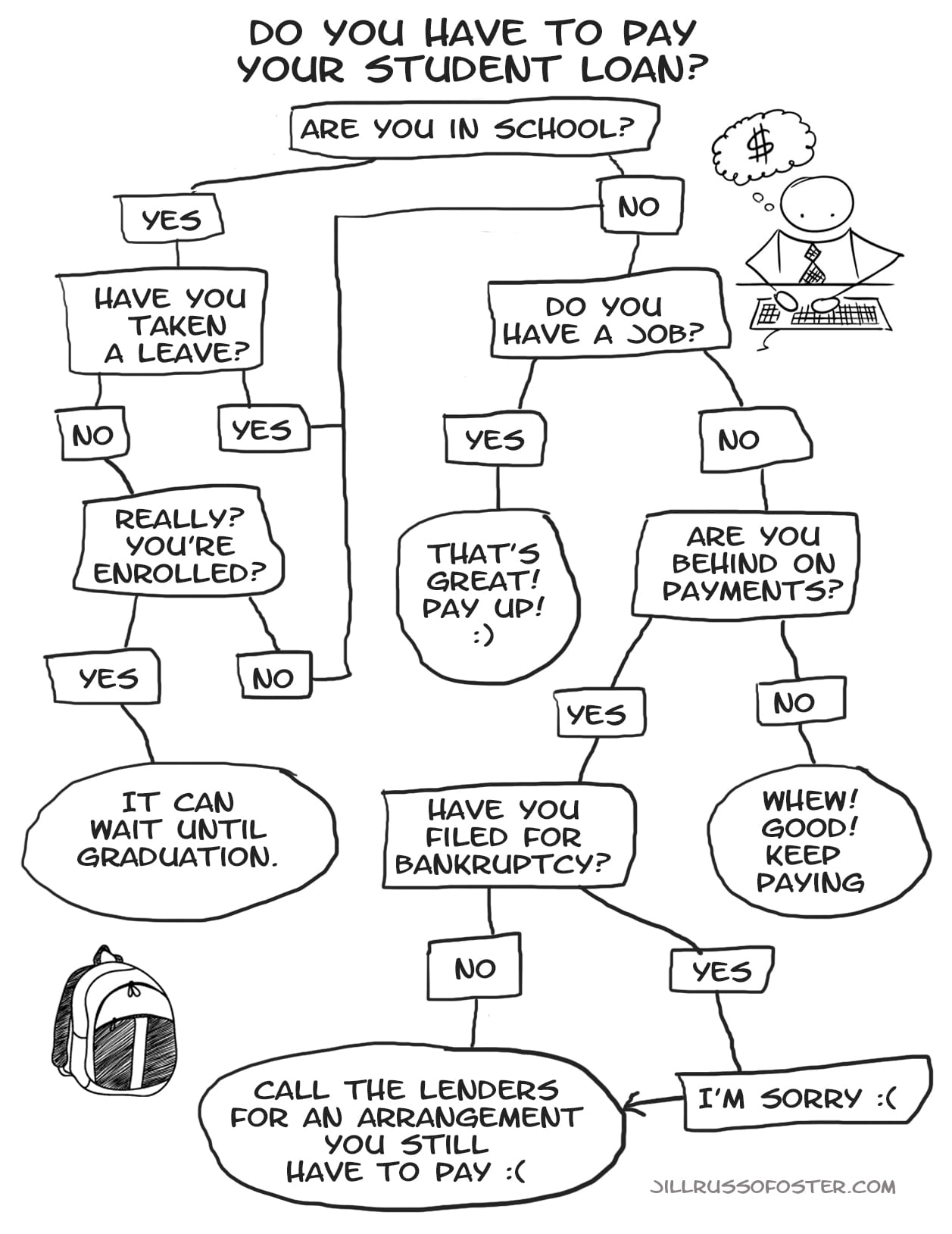

The last word on student loans for this series is about repayment. There are lots of things you need to be aware of. I am speaking about government loans. It may be the same for private loans, but not necessarily. You will need to check with your lender.

Never ignore any debt, especially student loans. Student loans are not included in bankruptcy. They have to be repaid. Interest charges add up, so sooner is better than later.

Student loans are deferred while you are in school. If you plan on taking a year or a semester off, you will have to start making payments. Will the loan go into deferment again when you return? Contact the lender to find out.

If you are having trouble repaying your student loans contact your loan servicer. Yes, this can be a scary call. Trust me, lenders want their money and most of the time they are willing to work with you to find a solution that works for you and them. Never promise to pay more than you can afford.

Some students have no idea what they owe or how many loans they have. This is not uncommon. As students scramble to make tuition, they may take out loans with several lenders over the years. They may also consolidate some loans while leaving others intact. If you feel like you’re missing the full picture, check your credit report at AnnualCreditReport.com to see a complete list of all outstanding debts. If you only want to see your government loans, you can go to the National Student Loan Data System (NSLDS).

Stay on top of all your debt to keep your finances in control.

I took a class this summer. The textbook was $60 used or $40 for a rental. Thinking I’d like to keep it for future reference, I decided to buy used. Imagine my shock when I discovered that the college bookstore didn’t carry the textbook for a class the college was offering. I had to prepay and have it ordered in.

I took a class this summer. The textbook was $60 used or $40 for a rental. Thinking I’d like to keep it for future reference, I decided to buy used. Imagine my shock when I discovered that the college bookstore didn’t carry the textbook for a class the college was offering. I had to prepay and have it ordered in. I’ll add a video here each day in April. The newest video will be on top. Scroll down for all budgeting tips you can handle!

I’ll add a video here each day in April. The newest video will be on top. Scroll down for all budgeting tips you can handle! As the weather turns to Spring, homeowner’s start to think about home improvements. Several years back, we did a major home improvement to our home and we had to make some tough decisions about what improvements to make. Do we make changes that will make our lives easier? Do we do something that would bring added value to the home? These are the tough decisions we had to make as homeowners.

As the weather turns to Spring, homeowner’s start to think about home improvements. Several years back, we did a major home improvement to our home and we had to make some tough decisions about what improvements to make. Do we make changes that will make our lives easier? Do we do something that would bring added value to the home? These are the tough decisions we had to make as homeowners. If you are planning to sell in the near future, then recouping your expenses is a major factor in your choice. Talk with a realtor and discuss what improvements will increase your home’s value and recoup your money.

If you are planning to sell in the near future, then recouping your expenses is a major factor in your choice. Talk with a realtor and discuss what improvements will increase your home’s value and recoup your money.