I am offering 10% off any of my books: Cash, Credit and Your Finances: The Teen Years, 111 Ways To Save and Thrive In Five: Take Charge of Your Finances in 5 Minutes A Day. Order your books today at https://www.jillrussofoster.com/products use promo code 10PercentOff to receive the discount.

#JillRussoFoster #FinancialLiteracyMonth

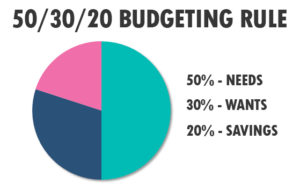

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category

This is a general rule about spending – 50/30/20 rule. 50 percent of your take home income should go towards your needs (such as food, housing, childcare, minimum debt repayment etc.), 30% towards your wants (dining out, travel, clothing, subscriptions, memberships) and the remaining 20% to your savings / debt repayment (emergency funds, retirement, additional payments towards debt). Nerd Wallet can tell you the amount for each category  Now that we are past the frost, it’s time to start our garden. I save our cardboard egg containers to use to start my seeds. Buying seeds (our library gives out free seeds) and starting them indoors will create a budget friendly alternative to buying vegetables at the grocery store. Don’t worry if you don’t have a yard, container gardening works just as well. Simply start with growing your own lettuce or herbs. It’s easy and will help your budget. #JillRussoFoster #FinancialLiteracyMonth

Now that we are past the frost, it’s time to start our garden. I save our cardboard egg containers to use to start my seeds. Buying seeds (our library gives out free seeds) and starting them indoors will create a budget friendly alternative to buying vegetables at the grocery store. Don’t worry if you don’t have a yard, container gardening works just as well. Simply start with growing your own lettuce or herbs. It’s easy and will help your budget. #JillRussoFoster #FinancialLiteracyMonth There are other types of insurance you need. If you own or lease a car, you need auto insurance. If you own a home / condo, you need homeowner insurance. If you rent an apartment, you need renter’s insurance. With what is going on in the country (floods, wildfires, mudslides etc.) Make a plan to have your needs assessed so that you’re covered for anything that may happen. #JillRussoFoster #FinancialLiteracyMonth

There are other types of insurance you need. If you own or lease a car, you need auto insurance. If you own a home / condo, you need homeowner insurance. If you rent an apartment, you need renter’s insurance. With what is going on in the country (floods, wildfires, mudslides etc.) Make a plan to have your needs assessed so that you’re covered for anything that may happen. #JillRussoFoster #FinancialLiteracyMonth

Let’s talk about insurance. Do you have all the insurance coverage you need? Do you have health insurance to cover medical care when needed? Most employers offer this to their employees. If you don’t have it through your job, there are other ways to access health insurance. Every state offers some type of insurance. One major medical incident can ruin a budget without insurance. #JillRussoFoster #FinancialLiteracyMonth

Let’s talk about insurance. Do you have all the insurance coverage you need? Do you have health insurance to cover medical care when needed? Most employers offer this to their employees. If you don’t have it through your job, there are other ways to access health insurance. Every state offers some type of insurance. One major medical incident can ruin a budget without insurance. #JillRussoFoster #FinancialLiteracyMonth Some of the things that we do in our household to save money: I cut my husband’s hair, we take our own recycle and trash to the transfer station, we walk to do our errands, we do our own yardwork (cutting lawn, trimming bushes, snow removal, etc.) #JillRussoFoster #FinancialLiteracyMonth

Some of the things that we do in our household to save money: I cut my husband’s hair, we take our own recycle and trash to the transfer station, we walk to do our errands, we do our own yardwork (cutting lawn, trimming bushes, snow removal, etc.) #JillRussoFoster #FinancialLiteracyMonth Do you have a surplus or deficit with your budget? We all know we can reduce or eliminate expenses. But sometimes this is not enough. Sometimes the answer will be that you need to increase your income or a combination of both. It’s something o think about. #JillRussoFoster #FinancialLiteracyMonth

Do you have a surplus or deficit with your budget? We all know we can reduce or eliminate expenses. But sometimes this is not enough. Sometimes the answer will be that you need to increase your income or a combination of both. It’s something o think about. #JillRussoFoster #FinancialLiteracyMonth